The real estate development arena in 2025 presents a landscape of dynamic opportunity intertwined with palpable caution. While demand drivers persist and innovation excites, developers seeking capital face heightened investor scrutiny fueled by market volatility, rising operational costs, intricate regulatory environments, and the sheer complexity of ambitious projects. In this climate, simply presenting a solid pro forma and a set of blueprints is often insufficient. Investors, tasked with deploying significant capital wisely, are digging deeper, demanding greater transparency, and rigorously assessing real estate investment risk before committing.

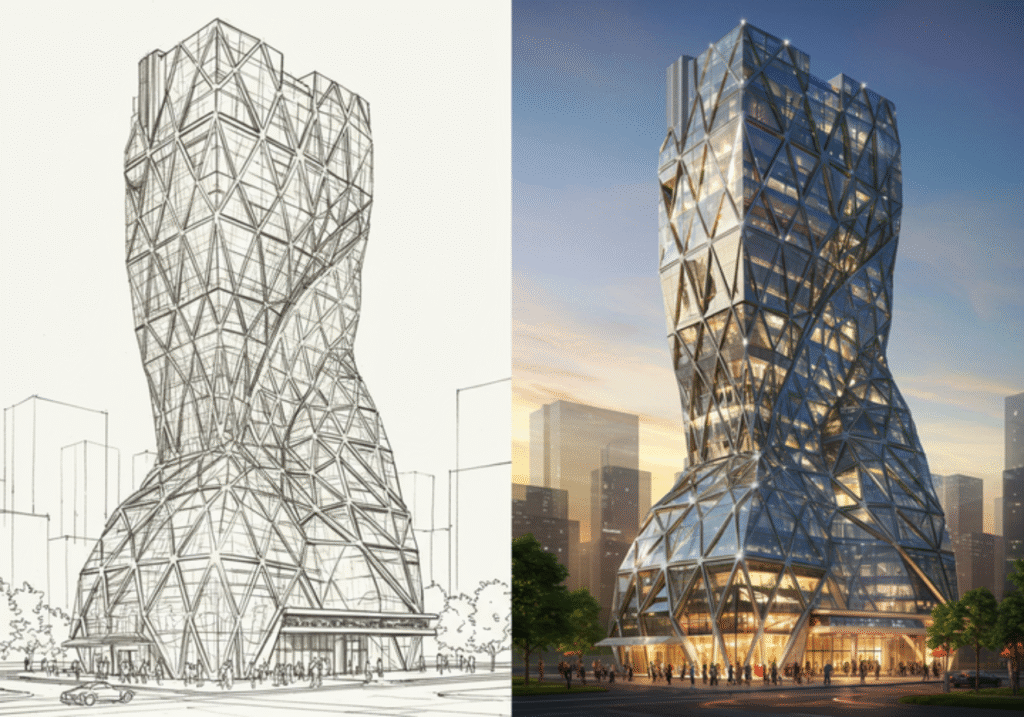

For developers aiming to navigate this challenging terrain and successfully secure securing development capital, the key lies in proactively building unshakeable confidence. This requires moving beyond traditional pitch methods towards a strategic presentation approach – one where sophisticated, high-impact visualization becomes an essential tool not just for showcasing vision, but for fundamentally de-risking the project in the eyes of potential backers. It’s about transforming uncertainty into clarity and demonstrating mastery over every project facet.

Before crafting a compelling presentation, it’s crucial to understand the pressures and priorities shaping investor decisions today. Investors are grappling with:

Failure to adequately address these concerns head-on can stall funding discussions or lead to less favorable terms. Developers must anticipate investor questions and provide clear, convincing answers, demonstrating not just vision, but viability.

Traditional presentation tools – static architectural plans, dense financial spreadsheets, text-heavy narratives – often struggle to fully address the nuanced concerns of today’s investors, especially for large-scale or innovative developments:

This communication gap can leave investors feeling uncertain, increasing their perception of real estate investment risk and hindering the process of securing development capital.

This is where strategic, high-fidelity visualization transforms the funding narrative. By employing photorealistic renderings, cinematic animations, immersive virtual reality (VR) tours, and data-integrated visuals, developers can proactively address investor concerns and dramatically reduce perceived risk during the crucial investor due diligence process:

Investing in a suite of high-impact presentation assets does more than just clarify the project; it sends a powerful signal to investors about the developer’s professionalism, commitment, and foresight. A polished, comprehensive, and visually compelling presentation demonstrates:

This level of preparation can significantly smooth the investor due diligence process and foster a stronger, more trusting relationship between the developer and potential capital partners.

Hypothetical Scenario: Consider a developer proposing a large, multi-phase urban regeneration project on a complex site. Their strategic presentation package might include:

* A cinematic animation providing an overview of the entire master plan and its integration with the surrounding neighborhood.

* Detailed phasing animations showing how infrastructure, public realm improvements, and individual buildings will be delivered sequentially, addressing logistical concerns.

* An interactive VR experience allowing investors to tour key components – a signature office building lobby, a residential unit, a retail plaza – experiencing the design quality and ambiance firsthand.

* High-fidelity renderings showcasing specific architectural features, amenity spaces populated with users, and the project’s contribution to the urban fabric.

* A secure online portal housing all these assets alongside financial models and due diligence documents, providing investors with seamless access.

This comprehensive visual approach directly tackles potential investor questions about complexity, market appeal, execution risk, and the overall viability, significantly de-risking the proposition.

Crucially, these high-impact presentation assets offer value far beyond the initial investor pitch. They become powerful tools for:

Leveraging these assets across multiple stakeholder groups maximizes the return on the visualization investment and streamlines the entire journey involved in securing development capital.

In the demanding investment climate of 2025, developers cannot afford to leave room for doubt. Building investor confidence requires more than compelling numbers; it requires building unwavering belief in the project’s vision, viability, and the team’s ability to execute. Strategic visualization is the most powerful tool available to achieve this.

By proactively addressing potential concerns, clarifying complexity, demonstrating market appeal, and showcasing meticulous planning through high-impact visual presentations, developers can effectively mitigate perceived real estate investment risk. This fosters the deep trust and transparency necessary to navigate the rigorous investor due diligence process and successfully secure the funding needed to turn visionary projects into reality. In today’s market, investing in visualization isn’t just about presentation; it’s about fundamentally de-risking the path to securing development capital and transforming investor uncertainty into unshakeable belief.

We craft stunning renderings and animations that bring unbuilt properties to life. Our work is all about capturing that magical “wow” moment. The kind that makes you see the future and feel inspired by what’s to come.